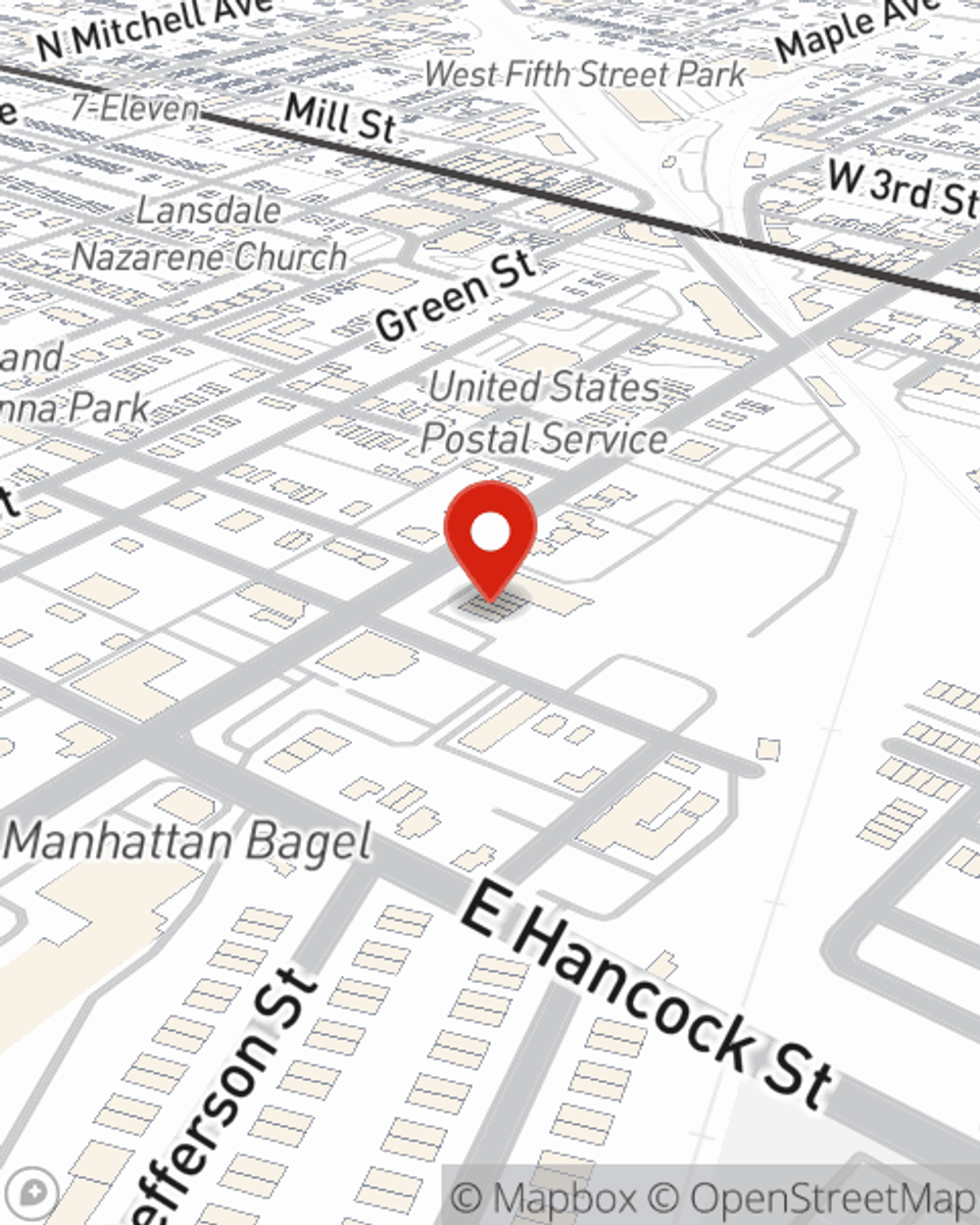

Business Insurance in and around Lansdale

Searching for insurance for your business? Search no further than State Farm agent John Stockmal!

No funny business here

Your Search For Remarkable Small Business Insurance Ends Now.

It takes courage to start your own business, and it also takes courage to admit when you might need support. State Farm is here to help with your business insurance needs. With options like a surety or fidelity bond, worker's compensation for your employees and errors and omissions liability, you can feel comfortable that your small business is properly protected.

Searching for insurance for your business? Search no further than State Farm agent John Stockmal!

No funny business here

Protect Your Future With State Farm

Whether you own a drug store, a photography business or an art gallery, State Farm is here to help. Aside from excellent service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Get right down to business by reaching out to agent John Stockmal's team to discuss your options.

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

John Stockmal

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.